The Woodlands, TX, November 8, 2023 – Excelerate Energy, Inc. (NYSE: EE) (the Company or Excelerate) today reported its financial results for the third quarter ended September 30, 2023.

RECENT Highlights

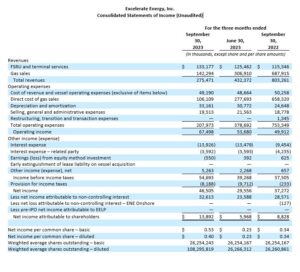

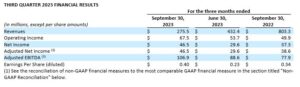

- Reported Net Income of $46.5 million for the third quarter

- Reported Adjusted EBITDA of $106.9 million for the third quarter

- Raised Full Year 2023 Adjusted EBITDA guidance; now expected to range between $340 million and $350 million

- Signed an agreement with Petrobras to charter the floating storage and regasification unit (FSRU) Sequoia for 10 years

- Signed a long-term contract to sell to Petrobangla 0.85 to 1.0 MTPA of LNG for 15 years beginning in 2026

- Declared a quarterly dividend of $0.025 per share, payable on December 13, 2023

CEO Comment

“The robust earnings we delivered in the third quarter are a testament to the quality of our contract portfolio and the growing demand for FSRUs around the world,” said President and Chief Executive Officer Steven Kobos. “Expanding our core regasification business remains an integral part of our growth strategy. With over $4 billion of predictable future contracted FSRU and Terminal Service cash flows, our financial position is stronger than ever.

“Continued geopolitical instability has underscored the importance of global energy security. The need for flexible LNG infrastructure and the essential services that Excelerate provides has never been greater. We take great pride in being a reliable provider of flexible LNG terminals and a preferred partner for countries seeking strategic energy solutions. Looking ahead, we will continue to deploy our assets to bolster energy security and advance the decarbonization initiatives for customers across our global footprint.”

Net Income and Adjusted EBITDA for the third quarter of 2023 increased over the prior year third quarter primarily due to higher rates on charters in Finland, Argentina, Brazil, and Germany, and lower operating lease expense resulting from the acquisition of the FSRU Sequoia in 2023, partially offset by the end of our contract in Israel in the fourth quarter of 2022.

Net Income and Adjusted EBITDA increased sequentially from last quarter primarily due to higher margins earned on gas sales contracts in Brazil, lower vessel operating expenses, and inflation index adjustments on certain contracts.

Key Commercial Updates

Brazil

In October 2023, Excelerate signed a 10-year Time Charter Party agreement with Petrobras for the FSRU Sequoia. The fixed fee contract will commence on January 1, 2024, and the vessel will be located at the Bahia Regasification Terminal in Salvador, Bahia, Brazil. Operational control of the Bahia Terminal is returning to Petrobras on January 1, 2024 per the regulatory guidelines provided by Brazil’s Administrative Council for Economic Defense.

Bangladesh

In November 2023, Excelerate signed a long-term LNG sale and purchase agreement with Petrobangla. Under the agreement, Petrobangla has agreed to purchase 0.85 to 1.0 million tonnes per annum (MTPA) of LNG from Excelerate for a term of 15 years beginning in 2026. Excelerate will deliver 0.85 MTPA of LNG in 2026 and 2027 and 1 MTPA from 2028 to 2040. The take-or-pay LNG volumes are expected to be delivered through Excelerate’s two existing FSRUs, the Excellence and Summit LNG, in Bangladesh.

Liquidity and capital resources

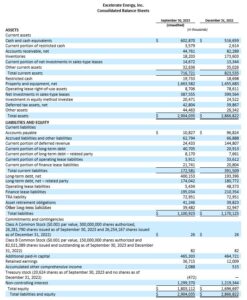

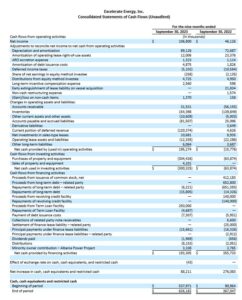

As of September 30, 2023, Excelerate had $602.9 million in cash and cash equivalents, $40.0 million of letters of credit issued and no outstanding borrowings under its $350 million revolving credit facility.

On November 7, 2023, Excelerate’s Board of Directors approved a quarterly cash dividend equal to $0.025 per share of Class A common stock, which will be paid on December 13, 2023, to shareholders of record as of the close of business on November 28, 2023.

2023 Financial Outlook

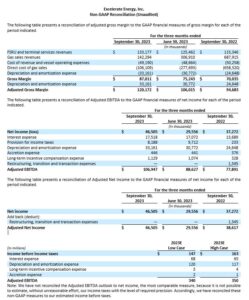

Excelerate is revising its full year 2023 guidance range. The Company now expects Adjusted EBITDA to range between $340 million and $350 million. Maintenance capex for 2023 is now expected to range between $20 million and $25 million.

Actual results may differ materially from the Company’s outlook as a result of, among other things, the factors described under “Forward-Looking Statements” below.

Investor Conference Call and Webcast

The Excelerate management team will host a conference call for investors and analysts at 8:30 a.m. Eastern Time (7:30 a.m. Central Time) on Thursday, November 9, 2023. Investors are invited to access a live webcast of the conference call via the Investor Relations page on the Company’s website at www.excelerateenergy.com. An archived replay of the call and a copy of the presentation will be on the website following the call.

ABOUT EXCELERATE ENERGY

Excelerate Energy, Inc. is a U.S.-based LNG company located in The Woodlands, Texas. Excelerate is changing the way the world accesses cleaner forms of energy by providing integrated services along the LNG value chain with an objective of delivering rapid-to-market and reliable LNG solutions to customers. The Company offers a full range of flexible regasification services from FSRUs to infrastructure development to LNG supply. Excelerate has offices in Abu Dhabi, Antwerp, Boston, Buenos Aires, Chattogram, Dhaka, Doha, Dubai, Helsinki, Manila, Rio de Janeiro, Singapore, and Washington, DC. For more information, please visit www.excelerateenergy.com.

USE OF NON-GAAP FINANCIAL MEASURES

The Company reports financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). Included in this press release are certain financial measures that are not calculated in accordance with GAAP. They are designed to supplement, and not substitute, Excelerate’s financial information presented in accordance with U.S. GAAP. The non-GAAP measures as defined by Excelerate may not be comparable to similar non-GAAP measures presented by other companies. The presentation of such measures, which may include adjustments to exclude non-recurring items, should not be construed as an inference that Excelerate’s future results, cash flows or leverage will be unaffected by other nonrecurring items. Management believes that the following non-GAAP financial measures provide investors with additional useful information in evaluating the Company’s performance and valuation. See the reconciliation of non-GAAP financial measures to the most comparable GAAP financial measure, including those measures presented as part of the Company’s 2023 Financial Outlook, in the section titled “Non-GAAP Reconciliation” below.

Adjusted Gross Margin

We use Adjusted Gross Margin, a non-GAAP financial measure, which we define as revenues less direct cost of sales and operating expenses, excluding depreciation and amortization, to measure our operational financial performance. Management believes Adjusted Gross Margin is useful because it provides insight on profitability and true operating performance excluding the implications of the historical cost basis of our assets. Our computation of Adjusted Gross Margin may not be comparable to other similarly titled measures of other companies, and you are cautioned not to place undue reliance on this information.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure included as a supplemental disclosure because we believe it is a useful indicator of our operating performance. We define Adjusted EBITDA as net income before interest expense, income taxes, depreciation and amortization, accretion, non-cash long-term incentive compensation expense and items such as charges and non-recurring expenses that management does not consider as part of assessing ongoing operating performance. In the first quarter of 2023, we revised the definition of Adjusted EBITDA to adjust for the impact of non-cash accretion expense, which results in a metric that is consistent with how management will review performance going forward. Management believes accretion expense does not directly reflect our ongoing operating performance.

Adjusted Net Income

The Company uses Adjusted Net Income, a non-GAAP financial measure, which it defines as net income plus the early extinguishment of lease liability related to the acquisition of the Excellence vessel, the non-cash write-off of deferred financing costs related to our prior credit agreement, and restructuring, transition and transaction expenses. Management believes Adjusted Net Income is useful because it provides insight on profitability excluding the impact of non-recurring charges related to our IPO.

The Company adjusts net income for the items listed above to arrive at Adjusted EBITDA and Adjusted Net Income because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA and Adjusted Net Income should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of the Company’s operating performance or liquidity. These measures have limitations as certain excluded items are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. The Company’s presentation of Adjusted EBITDA and Adjusted Net Income should not be construed as an inference that its results will be unaffected by unusual or non-recurring items. The Company’s computations of Adjusted EBITDA and Adjusted Net Income may not be comparable to other similarly titled measures of other companies. For the foregoing reasons, each of Adjusted EBITDA and Adjusted Net Income has significant limitations which affect its use as an indicator of its profitability and valuation, and you are cautioned not to place undue reliance on this information.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about Excelerate Energy, Inc. (“Excelerate,” and together with its subsidiaries “we,” “us,” “our” or the “Company”) and our industry that involve substantial risks and uncertainties. All statements other than statements of historical fact contained in this press release, including, without limitation, statements regarding our future results of operations or financial condition, business strategy and plans, expansion plans and strategy, economic conditions, both generally and in particular in the regions in which we operate or plan to operate, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “consider,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “opportunity,” “plan,” “potential,” “predict,” “project,” “shall,” “should,” “target,” “will,” or “would,” or the negative of these words or other similar terms or expressions.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this press release primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described under “Risk Factors” in Excelerate’s Annual Report on Form 10‐K for the year ended December 31, 2022, our other filings with the Securities and Exchange Commission (the “SEC”), and those identified in this press release, including, but not limited to, the following: customers’ contract termination rights or failure to perform their contractual obligations; risks and technical complexities inherent in operating the Company’s floating storage and regasification units (“FSRUs”) and other infrastructure assets; unforeseen delays, cancellations, expenses or other complications in developing the Company’s projects; regasification terminal or other facility failures; the Company’s need for substantial capital expenditures to maintain or replace FSRUs, terminals or other associated assets; reliance on third parties, including engineering, procurement and construction contractors; officer and crew shortages; the Company’s ability to maintain customer and supplier relationships and to source new suppliers; the Company’s ability to connect with third-party infrastructure; the Company’s ability to purchase or receive delivery of sufficient quantities of liquified natural gas (“LNG”) to satisfy contractual obligations and exposure to commodity price risk; changes in the demand for and price of LNG; the competitive market for LNG regasification services and fluctuations in hire rates for FSRUs; community and political group resistance to existing and new LNG and natural gas infrastructure due to concerns about the environment, safety and terrorism; access to financing sources on favorable terms; the Company’s debt level and finance lease liabilities that could limit its flexibility to obtain additional financing or refinance existing debt; catastrophic events, political tensions, conflicts and wars (such as the ongoing Russia-Ukraine war), health crises and pandemics; volatility of the global financial markets and uncertain economic conditions, including the impact of increased inflation and related governmental monetary policies; our ability to pay dividends on our Class A common stock and the timing and amount thereof; and the other risks, uncertainties and other factors identified in the Company’s filings with the SEC. All forward-looking statements are based on assumptions or judgments about future events that may or may not be correct or necessarily take place and that are by their nature subject to significant uncertainties and contingencies, many of which are outside the control of Excelerate. The occurrence of any such factors, events or circumstances would significantly alter the results set forth in these statements.

Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. For example, the current global economic uncertainty and geopolitical climate, including international wars, may give rise to risks that are currently unknown or amplify the risks associated with many of the foregoing events or factors. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this press release. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this press release relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

CONTACTS

Investors

Craig Hicks

Excelerate Energy

Craig.Hicks@excelerateenergy.com

Media

Stephen Pettibone / Frances Jeter

FGS Global

Excelerate@fgsglobal.com

or

media@excelerateenergy.com